Real estate property price trend in Toronto

Updated January 9, 2018

2017 was, in Toronto real estate, a volatile year. First quarter was characterized by frantic sales pace, bidding wars and quickly rising prices. In second quarter, on April 20th, Ontario Fair Housing Plan (FHP) was introduced, implementing a 15% non-resident speculation tax.

Introduction of FHP caused a decline in sales, particularly in freehold houses. Part of that impact was caused by uncertainty among prospective buyers, who waited to see how much decline in prices the new tax will cause. Many home owners who were planning to sell in the near future decided to do it sooner rather than later, and the number of new listings in

April

was 33.6% higher than in April 2016. That increase was fuelled by the rise of freehold listings, while condominium listings remained stable. Average price of detached homes was $1,205,262, condo apartments sold at an average of $541,392.Average time required to sell a listing was 9 days.

In

May

house sales were down, on a year-over-year basis, by 26.3%, condo sales were down by 6.4%. Active listings of freehold homes were significantly up at the end of May, while active condo listings were down. New listings were higher by nearly 50%. Average price of detached houses was up by 15.6% to $1,141,041, and condo prices increased by 28.4% to $531,659. Average time on the market was 11 days.

In

June

new listings were higher by 15.9% in comparison to June 2016, and sales were down by 37.3%. Sales of detached houses experienced the highest drop - 45%, while sales of condo apartments were down by 23.4%. Average prices were up ($793,915, or 6.3% more than in 2016). Price of detached homes was up by 7.8%, to $1,055,863. Condo apartments prices rose by 23.2% to $519,784. Average time on the market reached 15 days.

Summer is typically a slower period in real estate sales, and by

July

sales were down by 40.4% from the previous year level. Prospective buyers hoping to purchase a freehold house were still waiting and hoping for a decline in prices. Average price of detached houses rose by a very reasonable 4.9% to $746,218, but condo apartment prices were still increasing at a fast pace from last year levels (23.2%, to $501,750). Time required to sell a listing was 21 days.

August

sales were down by 34.8% prom the 2016 level, but new listings were also down, by 6.7%, and were at the lowest level since 2010. Average price was up by only 3% ($732,292), with detached house price in the City of Toronto lower by 1.2% (at $1,191,052) from last year's level. Condo apartment prices were up by 21.4%, averaging $507,841. Part of the decline in detached home prices was due to the fact that fewer high priced properties were selling. It took, on average, 25 days to sell a listing.

In

September

we had fewer sales (by 35% comparing to September 2016), but more new listings (by 9.4%). Average price was slightly up to $775,546, or 2.6% over last year's figure. Price of detached houses was the same as last year, at $1,015,067, and price of condos was again 23.2% higher than last year, averaging $520,411. Listings took, on average, 24 days to sell.

October

market was stronger, sold listings up by nearly 12% from September, although fewer by 26.7$ on a year-over-year basis. Average selling price was $780,104, or 2.3% higher than the previous year. Average price of detached houses was $1,008,207 (a drop of 2.5% from 2016), condo apartments averaged $523,041, which was 21.8% higher than in 2016. Time on the market was 23 days.

Sales in

November

were higher than in October, but still lower by 13.3% on a year-over-year basis. Some of that activity was likely due to the upcoming changes to mortgage lending criteria. Average price, at $761,757, was 2% lower than in November 2016. Price of detached homes dropped to $996,527, or 5.8% from the previous year. Price of condo apartments, at $516,965, was 16.4% higher than in November 2016. Listings required, on average, 24 days to sell.

In

December

averaage price was $735,021, just under 1% higher than at the same time in 2016. December sales were 7.1% lower on a year-over-year basis. Detached homes sold, on average, for $989,870, a 2.5% drop from 2016. Condo apartments recorded an average price of $503,968, an increase of 14.4%. Listings took, on average, 27 days to sell.

In summary

, 2017 had record sales in the first quarter, folowed by a decline in second and third quarter, and a more lively sales in the last quarter. Average price increased by 12.7% from 2016, but that increase was in large part due to the more substantial increase in prices for condo apartments which accounted for a large portion of all transactions.

Out of 14,334 freehold listings sold in the City of Toronto in 2017, 1,215 were sold for full price, 7,074 sold over asking and 6,042 sold below asking. The lowest, 66%, was paid for a row house at Lansdowne and Dupont, deemed unsafe and requiring major renovations. It was listed with an asking price of $585,000, and sold for $385,000 in 16 days. The highest, 198%, was paid for a detached bungalow near Bloor and Christie, listed with an asking price of $499,000 and sold for $988,018 (or nearly half a million more).

270 freehold homes sold on the day the listing was signed, 529 in one day, 655 in two days, and 582 in 3 days.

19,340 condominium apartments were sold in the City of Toronto in 2017. Out of these, 2,808 sold for full asking price, 8,218 sold above asking and 8,314 sold below asking. The lowest, 69%, was paid for a massive unit in Shangri-La Hotel, listed just under 9 million, and sold for $6,200,000. Nine units sold for up to 80% of asking, 150 between 81% and 90%. The highest, 178%, was received for a spacious penthouse near Scarborough Town Centre, listed with an asking price of $359,000 and sold with a bully offer for $638,000.

285 condo units sold on the day the listing was signed, 897 sold in one day, 1,200 in 2 days and 987 in 3 days. It would be fair to guess that at least 285, and very possibly just over 1000 units were sold without review of the Status Certificate.

The following factors affect our real estate market.

-

Bank of Canada increased the key interest rate twice in 2017 - on July 12, to 0.75%, and on September 6 to 1%. Prime rate, which was 2.7% since July 2015, was increased at the beginning of August to 2.95%, and at the beginning of November to 3.2%. Interest rates which have been very low for a number of years, keeping the real cost of purchasing a house, townhouse, condo apartment or loft reasonable. On January 1, 2018, a new minimum qualifying rate is required for all mortgages, including the ones where the down payment is 20% or greater. Buyers have to qualify for a five-year benchmark Bank of Canada rate, or the contractual mortgage rate plus 2%, whichever is greater. In the recent past only insured mortgages (where down payment was under 20%) were subjected to "stress test".

-

Multi-unit dwellings qualify only for a higher rate, usually another 0.25% higher than a principal residence, unless the buyer will live in one of the units.

-

Change in mortgage lending rules in the recent past reduced the amount of loan for which the first time buyers with low down payment would qualify. Most recently introduced change requires a down payment of 10% for the amount of mortgage over $500,000. Buyers need to have 5% down for the first $500,000 and additional 10% of the loan sum above that amount.

-

Properties selling for over 1 million no longer qualify for government insured mortgage.

-

Young people, immigrants, and foreign investors are still fueling the demand, while older generation stays longer in their homes.

Ontario Greenbelt Aliance urge the province to expand the existing greenbelt and freeze urban boundaries to protect agricultural land and water sources in the Golden Horseshoe. Freezing urban boundaries contributes to the rise in land value.

New Ontario Fair Housing Plan (FHP) was introduced on April 20, 2017, imposing a 15% non-resident speculation tax.

New Toronto Land Transfer Tax was introduced in 2009, and Harmonized Sales Tax came into effect in July of 2012. The later does not have a great impact on purchases of resale homes, other than adding to the closing costs, but will be felt by buyers of new construction.

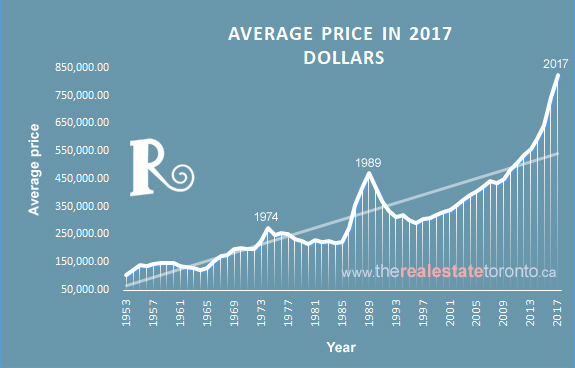

Using average house prices on record since 1953, corrected for inflation (for comparison purposes we brought the historical data up to today's equivalent values), I produced the following graph. The average prices are courtesy of TREB.

On the graph below you will see three 'spikes' in house prices, and three 'dips'. Straight line denotes the trend. In 1974 and 1989, when the average prices rose steeply above the trend line, a 'correction' ensued. We can also see a small correction as a result of late 2008 and early 2009 market conditions. The rate of price gains between 2013 and 2015 was a bit lower that the one which led to the 'bubble burst' of 1989. Last three years rise is steeper, but, at 17.31% for 2016 and 12.71% for 2017 it is still less than a half of the 36% yearly increase that happened in 1987, and the 33.3% increase from 1974. Each correction led to a period of stable prices, especially when these prices were corrected for inflation.

At the beginning of 2010, when the average house price reached $431,433 (which, corrected for inflation, amounts to $470,350), the price line has crossed over the trend line. The increase rate, initially moderate, was higher between 2013 and 2015, and . The brief correction which happened in 2007 - 2008 was more of leveling off the prices, similar to the period between 1957 and 1960. After that brief correction the prices continued to rise, and the increases were quite substantial since 2010.

When the prices rise faster than the trend suggests, the market eventually slows down. Whether the prices become stable, following the trend line, or actually drop, seems to depend on the speed with which the price increases happen. The steeper the angle of the curve representing house prices, the more likely is a price 'correction'.

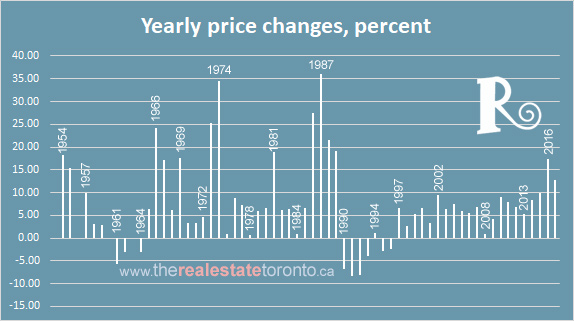

While the recent rise in real estate prices in Toronto is quite significant, the year-over-year changes in prices (not corrected for inflation) have lately been much more moderate than in previous years (see graph below). You will also notice that the largest single decrease in price was approximately 8%, while the largest increase (in 1987) was around 36%.

If you are interested in more detailed information about the market in a specific area, please call Marisha Robinsky, real estate sales representative, Bosley Real Estate Ltd., Brokerage, 416-322-8000.